STP – Systematic Transfer Plan

The new financial year has begun and it’s the appraisal time of the year. A lucky few will also get their bonuses. The common question here is what to do with all this Dhana Laabh. How to invest this money in the current scenario? The mutual fund industry has come up with a solution wherein you can invest money in one scheme and transfer small portions to another scheme every month. Both the schemes are of your choosing. This feature is called the Systematic Transfer Plan, STP.

Let’s take an example,

Akshay works in an MNC. He was recently promoted to managerial level and got a bonus of ₹ 1 lakh as an appreciation for his work. He already has an ongoing SIP from his regular income every month. Akshay wants to invest this bonus amount as soon as possible because he is afraid, he might just spend it all if it stays in his savings account for too long. So, what are his options?

- Invest the entire amount in equity mutual funds – This approach is a bit risky since you never know if the markets will go up or fall in the near future. You may not be willing to take a risk for that big of an amount.

- Keep the money in a savings account and start an SIP – The problem here is, for the longest time, the amount stays in the savings account, earning very low returns and there’s always the risk of spending too much without even realizing it.

- Start a Fixed Deposit – If you look at the current FD rates, you won’t find them at all attractive.

- Invest the entire amount in debt mutual funds and start systematic transfers into equity mutual funds.

Let’s see how the last option works.

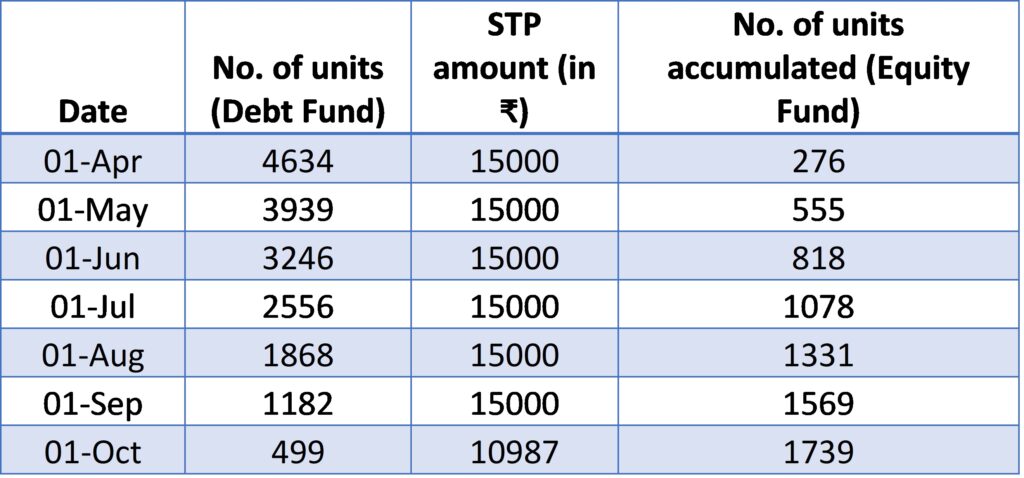

Suppose Akshay invests the bonus amount of ₹ 1 lakh in a debt mutual fund scheme. He buys 4634 units of debt mutual fund from his initial investment. Now, he starts an STP of ₹ 15,000 on the 1st day of every month from the debt mutual fund to an equity mutual fund. Let’s see how it pans out.

The NAVs considered in the above calculation are the FY 21-22 NAVs of ICICI Pru Ultra Short-Term fund for Debt fund and ICICI Pru Bluechip fund for Equity fund.

In April, STP of ₹ 15,000 buys 276 units of equity mutual fund. The units left in the debt mutual fund after the sale of ₹ 15,000 are 3939. In May, STP of ₹ 15,000 buys 279 units of equity mutual fund, taking the tally to 555 units. The number of units now left in the debt mutual fund are 3246. This continues till all the units in debt mutual fund are transferred to equity mutual fund. As can be seen in the table, the systematic transfer of funds takes 7 months to complete in this case. At the end of 7 months the amount accumulated in the equity mutual fund is about 1.12 lakhs.

The advantage of investing in debt mutual funds over keeping the money in a savings account is two-fold. Firstly, you cannot accidentally spend the funds like the money in savings account. Secondly, the returns from debt mutual funds are usually slightly better than those of a savings account. The advantage of investing in equity mutual funds in such a phased manner is to reduce the risk of market timing and averaging out the cost of buying mutual fund units.

Note: The amount at the end of the STP period can go higher or lower than the original invested amount in accordance with the prevalent market conditions.

Leave a Reply