How to write a cheque?

Have you ever written a cheque? As our country moves towards digitalization, people have become more comfortable with net banking, UPI, and e-wallets than writing a cheque. Still there are instances where the payment may be a large amount or the other party does not accept an online transfer of funds. In such cases, you may have to write a cheque.

Writing a cheque can seem like a very easy task for most people. But make one mistake and it can become a huge loss for you. Let’s look at the various components in a cheque that you need to know about.

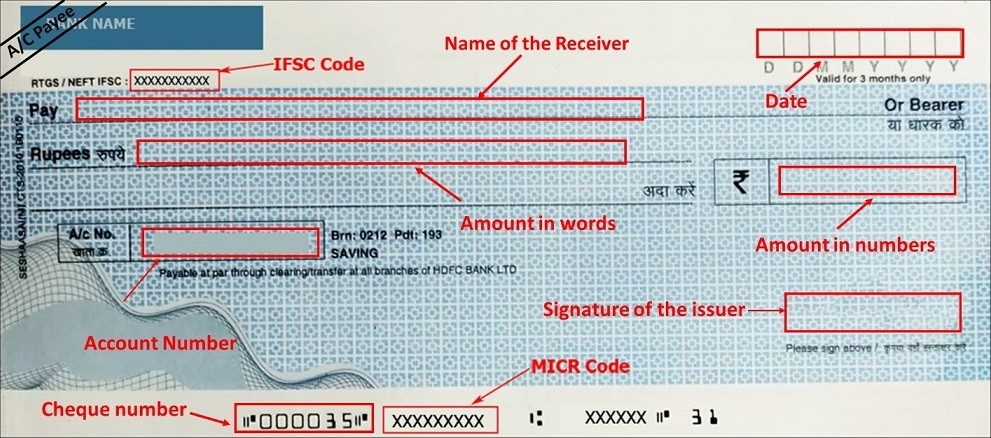

- IFSC code (Indian Financial System Code): This is an 11-digit unique code assigned to each branch of every bank by the Reserve Bank of India.

- Bank name, branch name, and address: These are the details of the payer’s bank.

- Account number: This is the payer’s bank account number.

- Cheque number: It is a unique number given to each cheque. In case a cheque goes missing or the expected transaction does not take place, this number can be used to trace its whereabouts.

- MICR code (Magnetic Ink Character Recognition technology): This 9-digit code is used to identify the city, bank, and branch of the bank account to which the cheque belongs.

How to write a cheque?

Before writing a cheque, make sure that the desired funds are available in your bank account. Cheque bounce is a criminal offense.

- Start with the date. This is an important field since a cheque remains valid for only three months from the date of issuance.

- Draw two parallel lines at the top left corner of the cheque and write A/C payee in between, as shown in the image, and cut off the “or Bearer”. This is to make sure that the cheque gets deposited only in the bank account of the receiver. Otherwise, anybody in possession of the cheque will be able to withdraw the money just by visiting the bank.

- Fill in the name of the receiver in the field “Pay”. If the receiver is an individual, mention their first and last name. If the receiver is a company, write its exact name. It is always a good practice to confirm the name of the receiver before writing the cheque. This is to avoid any ambiguity concerning the payment. Draw a line to fill in the empty spaces so that nobody can make any alterations once you have written the cheque.

- The next step is to fill in the amount in words to the right of “Rupees”. Do not leave space between “Rupees” and the amount. Always add ‘Only’ after writing the amount in words. You don’t want someone to add an extra word at the beginning, in between, or at the end. Also, avoid leaving spaces in between the words. A “Seven” can easily become a “Seventy” if you are not careful.

- Repeat the same exercise but this time in the box titled “₹”. Here you need to fill in the figure of the amount of cheque you want to write. Start writing from the leftmost side of the box and add ‘/-’ at the end of the number. Again, avoid leaving space in between the numbers.

- Make sure you fill in all the details mentioned above correctly. If you make a mistake while writing the cheque, it is best to void the cheque and write a new one. The Cheque Truncation System (CTS), which is an automatic image-based cheque clearing system implemented by the RBI, will invalidate the cheque if it detects any overwriting.

- Tear the cheque from the checkbook, keep it on a smooth surface, and sign. If you sign the cheque while it’s still attached to the checkbook, your pen might leave an impression of your signature on the next cheque. The signature should match the one registered in your bank account.

- The final step is to fill in the cheque details on the slip provided in your checkbook for your record.

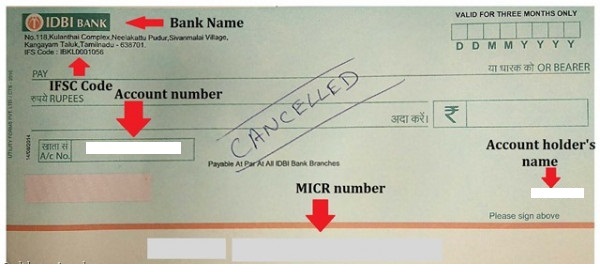

Cancelled Cheque

In addition to making a payment, you can also use the cheque as proof of your bank account. For example, when you decide to buy mutual funds or bonds, you need to mention your bank account details for investment and payment purposes. The investment provider needs to ascertain that the bank account mentioned by you is authentic, belongs to you, and is active. A simple cancelled cheque of your bank account with your name mentioned on it serves the purpose. Make sure while cancelling the cheque, details such as your name, bank account number, bank name, IFSC code, and MICR code do not get crossed.

Every day there are news stories of bank frauds, cheque forgeries, and phone call scams. We need to make sure that our hard-earned money stays safe with us. So be careful while handling cheques, OTPs, e-wallets, net banking, and other such facilities.

Better safe than sorry!

Leave a Reply