Retirement! When do I start saving for it?

A group of friends in their late-20s meet at their college reunion. They discuss their jobs, bosses, incentives, salaries and loans. Those who are financially astute discuss saving for their wedding, investments for children’s education and wellbeing, and their foreign travel. The thought of retirement doesn’t even cross their minds. Why would it? They are in the prime of their life and they still have a long road to retirement! This is where most of them go wrong.

Akshay completed his education at the age of 25. He immediately started working in an IT firm and had a steady income. At the age of 27, he got married and started a family at 29. Akshay plans to retire at 60 after sending his children to college. Akshay estimates that a corpus of ₹ 3 crore would be enough to lead a comfortable retirement life.

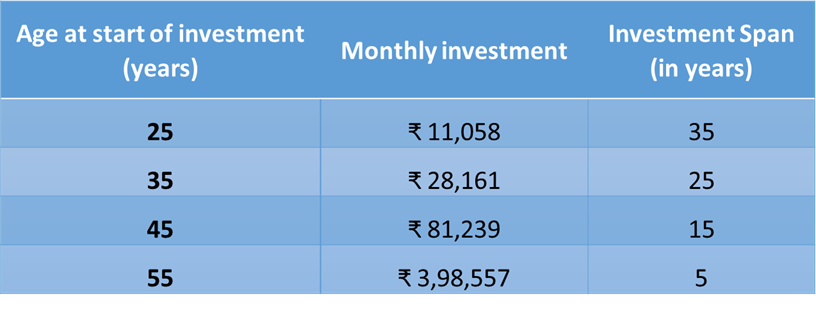

Let us consider various alternatives to achieve this goal.

Had Akshay started putting aside an amount from the age of 25, he would have easily reached his target by the time of retirement by investing ₹ 11,000 every month. Instead, if he starts saving at 55, as many people do, he would need to invest almost ₹ 4 lakhs monthly solely for retirement. Taking into account other regular expenses, this becomes infeasible.

You spend months planning your wedding or your child’s first birthday. All this preparation is just for a single day. Whereas, you will spend 20 to 30 years in retirement. Consider the amount of time you ought to spend planning for it.

Money management is a major source of conflict within families. You will not like being financially dependent on your grown-up children, will you? Even after retirement you would want the freedom to do whatever you like and go wherever you desire. Financial independence is imperative to achieve it.

Coming back to the question –

When do I start saving for retirement?

– From your very first paycheck!

Leave a Reply