Nomination

When you open a bank account, you come across a field in the application form to fill in your nomination. You generally add your parent’s, spouse’s or children’s names as nominees. Many times, it is left blank. The nomination field is also in other investments such as mutual funds and fixed deposit (FD) etc. This is a crucial field, but since it is not mandatory in most cases, we often neglect it. Before we discuss the importance of this field, let us first find out what nomination means.

What is a nomination?

A nominee is a custodian of an asset till its transfer to the rightful owner. It means that a nominee is only a temporary caretaker of the financial asset. This ensures that the asset is not left without a caretaker till the time it is transferred to the rightful owner. It helps the ongoing investment to easily carry on without delay after the death of the original owner.

A nomination is not the same as Will. Suppose person A starts an FD and appoints person B as his/her nominee. Person A makes a Will in which he names person C as the next owner of the investment. In this case, the Will supersedes a nomination. That means after person A dies, the rightful owner of the FD will be person C. Person B will only play the role of a caretaker until the Will is executed.

Why is nomination necessary?

Let’s take a few scenarios.

(Disclaimer: The examples discussed here for mutual funds are true for most financial assets except the Demat account and company shares.)

Scenario 1

Aishwarya invests in mutual funds where she is the primary account holder and Abhishek as the secondary account holder. Now in the event of Aishwarya’s death, Abhishek will only have to request for a change in primary account holder by providing proof of death. The mutual fund house will treat it as a separate account with Abhishek as the primary holder and transfer the mutual fund units to this account. Thus, he becomes the owner of this asset.

Scenario 2

Aishwarya invests in mutual funds and is the sole account holder. She appoints Abhishek as her nominee. In the event of Aishwarya’s death, Abhishek will have to provide proof of death and related documents along with a request to transfer the mutual fund units to his name. He will also need to get his own details verified by a concerned authority.

Scenario 3

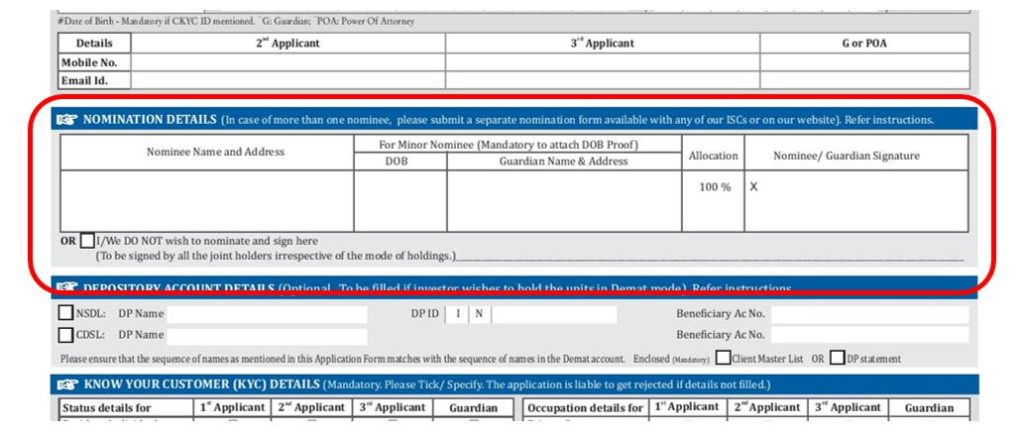

Aishwarya invests in mutual funds and is the sole account holder. She has named both Abhishek and Aaradhya as nominees with a 50 percent allocation of funds to each one of them. As Aaradhya is a minor, her guardian will take care of her portion of allocated mutual fund units till she turns 18. In the event of Aishwarya’s death, Abhishek and Aaradhya will have to provide proof of death and related documents along with a request to transfer 50 percent of mutual fund units to each of their names.

The process in Scenario 2 and 3 is slightly different than in Scenario 1. But in the above three scenarios, the process of transfer of wealth is very straight forward and gets executed in under 15 days. Determining the successor may take time in cases where it is not clearly stated in the Will. In such cases, having a nominee makes things easier.

Scenario 4

Aishwarya invests in mutual funds and is the sole account holder. She has not named anyone as her nominee. In the event of her death, her wealth will be distributed as per her Will (if presented) or by the Law of Succession (in the absence of a Will). Till the time the legal heirs are determined, the assets (in this case, the mutual fund units) are left without an owner or a caretaker. Also, after the legal heir is decided, the transmission process (transfer of wealth to the legal heir) can be a tedious process involving a lot of legal paperwork and multiple visits to various concerned offices.

There is no downside to appointing a nominee. As long as you are alive, you have complete control over your investment. The nominee will not be able to make any alterations.

So, make sure you fill in the nomination field every time you invest. If your current investments do not have a nomination, you can always appoint a nominee by sending in a request!

Is there any fixed format to prepare will ?

Is it mandatory to register the will ?

There is no fixed format available to prepare a Will.

It is not mandatory to register the Will but it is highly recommended to avoid any disputes.