Mutual Funds

You decide to invest. The share prices or bond prices may fluctuate. The banks may go bankrupt, gold price may fall. In each case, your investment may suffer. As an investor, one should never solely depend on a single financial instrument to give secure returns, may it be shares of a company, bonds, or even a bank. One should diversify.

The chart displays the performance of some well-known stocks and gold over 10 years. As shown, for every instrument, the performance varies at any given point.

Don’t put all your eggs in one basket!

Alas, it’s easier said than done. If you plan to diversify your investments, you need a hefty stack of money to invest separately in each financial instrument. Managing these individual investments can be a headache. Furthermore, some markets are only available for corporate investors with a large investment corpus. In such cases, the retails investors who have smaller purses, lose out on investment opportunities.

Mutual funds serve as a great alternative if you want to diversify your investments. A mutual fund pools the investments acquired from number of investors. Later, it invests this pool in various securities of various asset classes in different proportions as per declared mandate. A fund manager takes these decisions. Thus, the investor gets a proportionate exposure to all the securities in which the mutual fund has invested.

Types of Mutual Funds

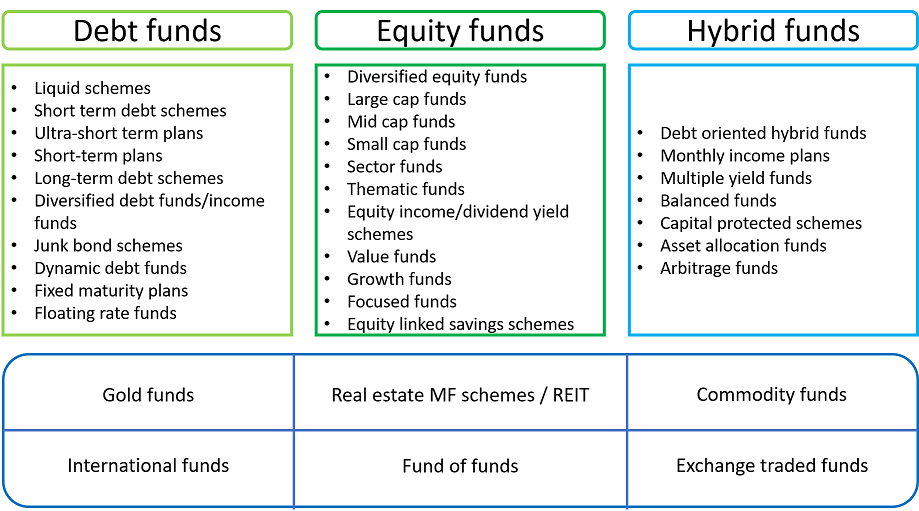

There are several mutual fund types. They are categorized based on whether they are open-ended or closed-ended, or whether they are actively managed funds or passive funds. They are also classified based on their exposure to equity and debt securities.

There are various sub-types, each of which forms a mutual fund scheme. Your desired asset allocation, expected returns, and investment duration will help choose the scheme.

Services provided

Another advantage of investing in mutual funds is the number of automated services it provides to make it easier for the investors to stick to their investment goals.

- Systematic investment planning (SIP): SIP is a method of investing in mutual funds where you invest a fixed amount periodically.

- Step-up SIP: Mutual funds provide the facility to increase the investment amount gradually.

- Systematic withdrawal planning (SWP): It allows the investor to withdraw a fixed amount periodically to get a regular income.

- Systematic transfer planning (STP): An investor can shift a fixed amount from one scheme to another periodically.

India has a total of 47 fund houses and together they encompass over 2000 schemes. Choosing the right scheme from an array of schemes can be daunting if you do not have a good knowledge of the field.

To make the best use of all the asset classes to enhance your investment portfolio get in touch with a Certified Financial Planner.

Leave a Reply