Are fixed deposits always safe?

All investments are typecast to have specific characteristics. People don’t tend to think beyond those characteristics before putting their money in them. For example, FDs are safe and steady investments, the share market is a “high-risk high reward” investment, gold is a solid investment, and so on. While generally speaking these typecasts are not wrong, the non-obvious factors should also be considered while investing in them.

The Fixed Deposits

Banks, non-banking financial companies (NBFCs) and corporates provide these schemes to deposit a certain amount for a fixed period. The investment period can be as short as 7 days and as long as 10 years. Depositors can withdraw their money before the FD matures. In this case, they will have to pay a penalty. The rate of return (interest rate paid on the invested amount) is also pre-decided. This gives the depositor a sense of security.

The older generations have been investing in FDs for many decades. It is the go-to investment channel for the typical Indian household. Many of our parents still swear by it and would never dare to go beyond it. FDs are their comfort zone. But are the fixed deposits really safe?

Let’s recollect the past, shall we?

PMC Bank, a co-operative bank, provided fixed deposit schemes. On 23rd September 2019, the Reserve Bank of India (RBI) placed PMC Bank under various restrictions after it became aware of some financial irregularities. This led to hundreds of customers and fixed deposit holders suddenly finding themselves in a cash crunch. Many of them had their entire life savings deposited in the bank just for the sake of getting an extra 0.5% interest over the well-established commercial banks. To this day, depositors are still struggling to get their money back. They may never get the entire amount. Rupee Co-operative Bank and CKP Co-operative Bank are a few examples who followed a path similar to that of the PMC Bank.

Some people prefer corporate FDs over bank FDs since corporates tend to give a slightly higher interest rate. Over the years companies like Llyod Finance Ltd., Micro Technologies, and Elder provided fixed deposit schemes at a much higher rate of interest as compared to the bank deposits and defaulted/delayed on the repayment of the interest as well as the principal amount. The most recent example is DHFL which has about 27,000 fixed deposit holders who may never get their entire money back.

So how to choose an FD provider?

There are many FD providers in the market today. You want to give your money to the one who will repay your principal amount on time along with the pre-decided interest.

People usually tend to choose an FD scheme with the highest interest rate, assuming that all FD schemes are safe. That is not always the case. In 2012, Micro Technologies was offering an interest yield of 14.89% for the deposits. When a company starts offering such high interest rates it is usually a sign that the company is in great financial distress.

Credit rating

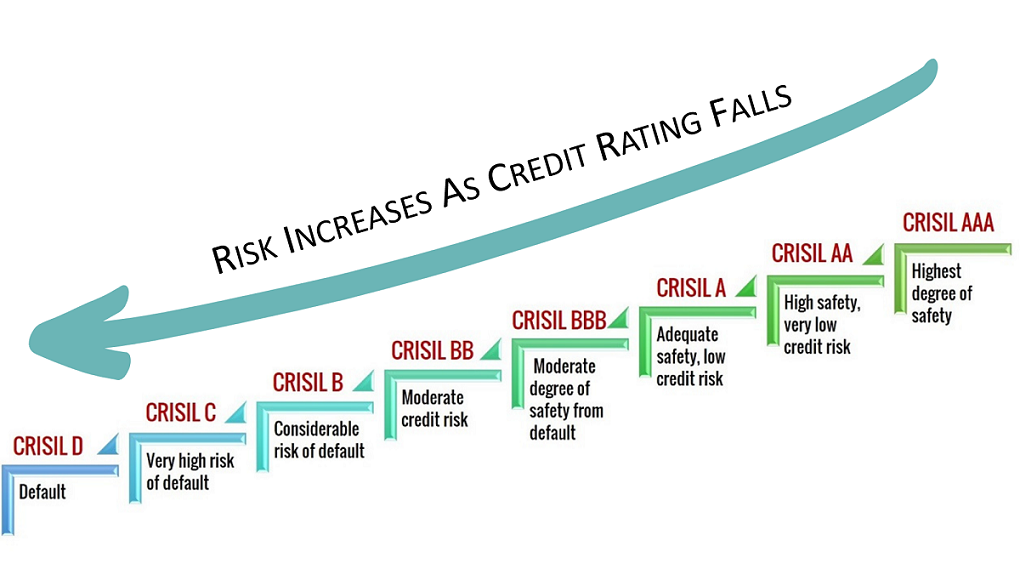

To ensure the safety of your investments there are a few credit rating agencies in India such as CRISIL, ICRA, CARE, etc. These agencies evaluate the FD provider based on its track record, customer service, existing debts, business line and management, liquidity status, and so on. As per the evaluation, the FD provider is categorized on the rating scale.

For example, CRISIL provides ratings ranging from CRISIL AAA (Highest safety) to CRISIL D (Default).

Things to keep in mind while choosing an FD scheme

Credit rating

Choose the FD schemes with a AAA or AA rating. The lower you go, the riskier your investment becomes.

Tenure

The duration for which you want to put your money in an FD scheme. You need to decide exactly when you want your money back and choose the tenure accordingly. Here, your financial planning comes into play.

Interest rates

While finalizing on the FD provider, you should compare the interest rates with its peers who have the same credit rating. Choose the one which gives the best returns without compromising your risk. Beware of extremely high interest rates.

Penalty rates

It’s not a good idea to break an FD. But sometimes due to unforeseeable circumstances you are left with no choice. If such a situation arises, you shouldn’t have to pay a big penalty to the FD provider. So, choose a provider with a low penalty rate.

Payment of interest

Payment frequency of interest can be monthly, quarterly, semi-annually and annually. Choose the one which best suits your need.

Detailed Explanation